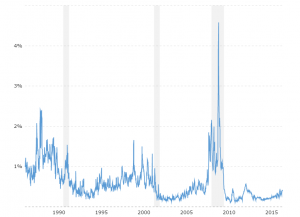

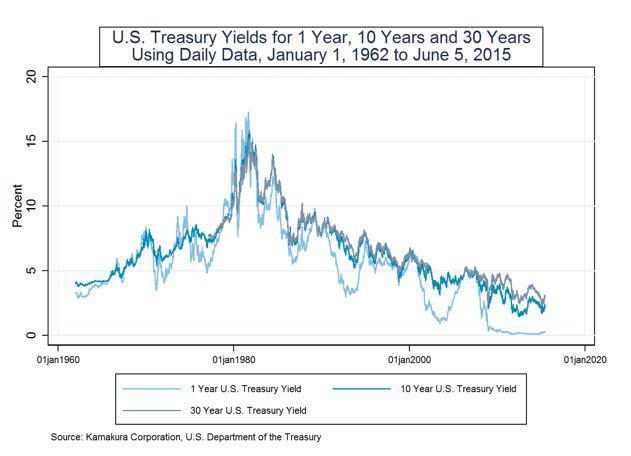

Market Yield on U.S. Treasury Securities at 1-Year Constant Maturity, Quoted on an Investment Basis (DGS1) | FRED | St. Louis Fed

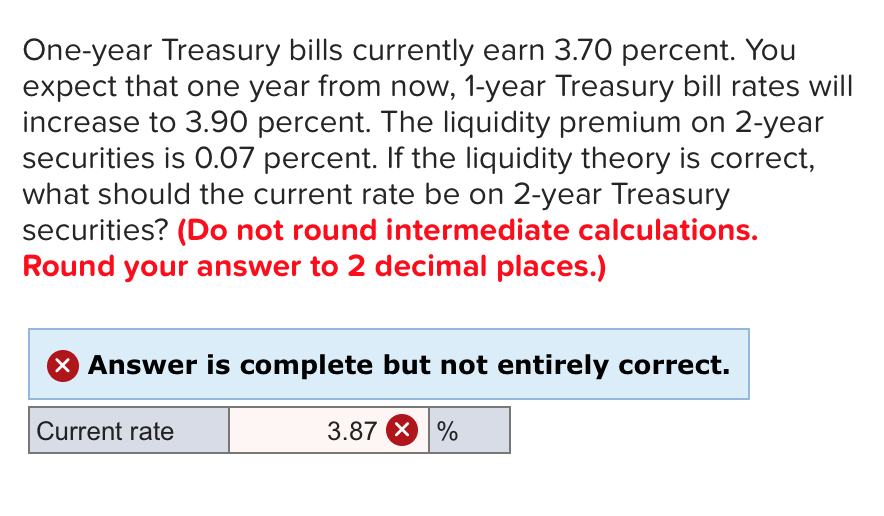

SOLVED: One-year Treasury bills currently earn 4.55 percent. You expect that one year from now, one-year Treasury bill rates will increase to 4.70 percent. The liquidity premium on two-year securities is .090

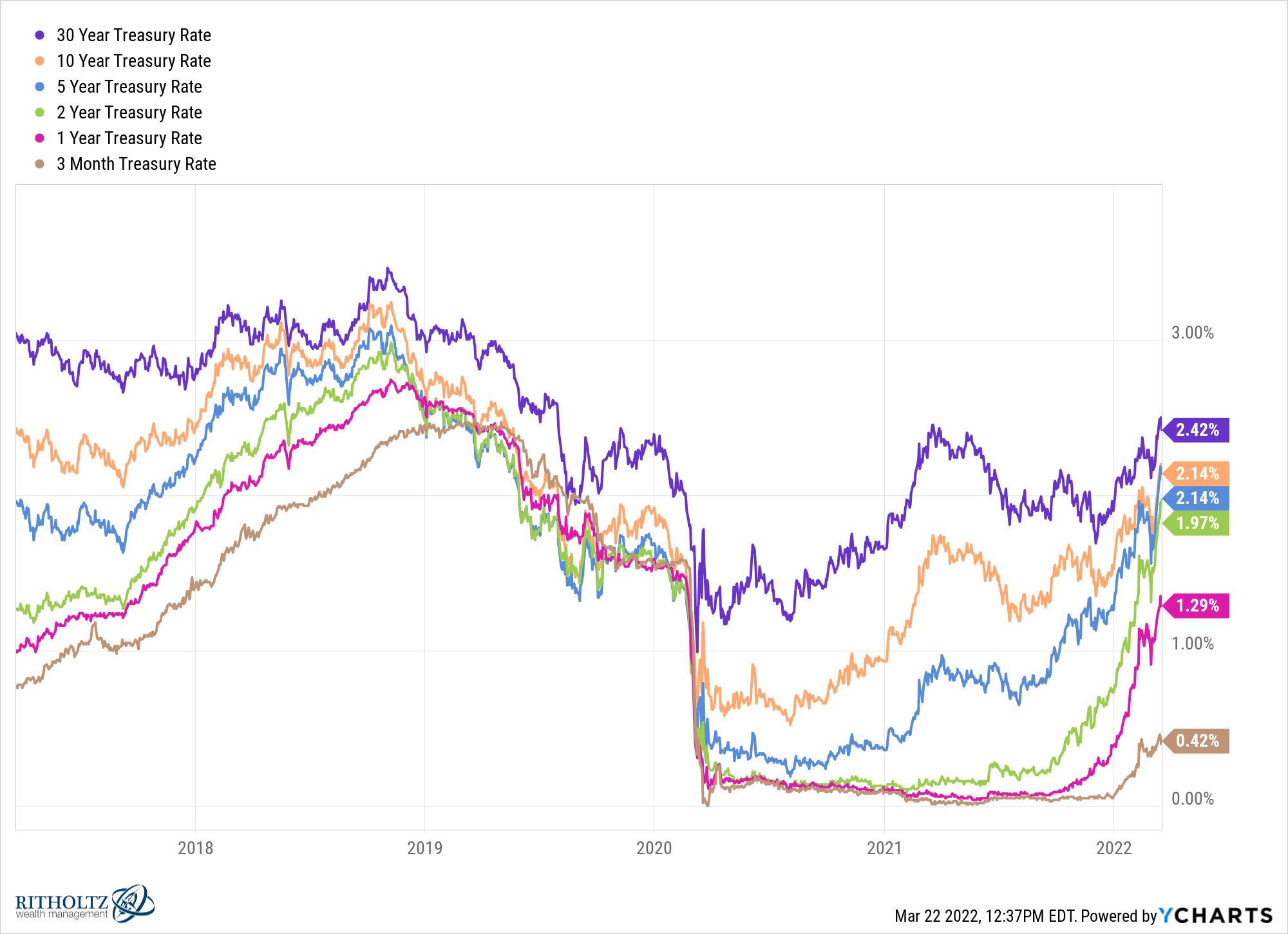

Treasury Bond Massacre, Mortgage Rates Hit 5.35%, Highest since 2009, and it's Only April | Wolf Street

One-year Treasury bills currently earn 2.45 percent. You expect that one year from now, 1-year Treasury - Brainly.com

The 3-Month T-Bill Rate: 2025 Forecast Jumps 0.20% To 3.22% As Long Yields Set Yearly Highs (NASDAQ:TLT) | Seeking Alpha

Forward T-Bill Rates Surge 0.26% In 2019, Projected 10 Year Treasury Yield In 2024 Up 0.15% (NASDAQ:TLT) | Seeking Alpha