Realized And 'In Progress' Term Premiums For U.S. Treasury Yields: 10 Years Vs. 6 Months | Seeking Alpha

![Chapter 3. Forward rates, T-bill futures, and quasi-arbitrage - Fixed Income and Interest Rate Derivative Analysis [Book] Chapter 3. Forward rates, T-bill futures, and quasi-arbitrage - Fixed Income and Interest Rate Derivative Analysis [Book]](https://www.oreilly.com/api/v2/epubs/9780750640121/files/bg4a.png)

Chapter 3. Forward rates, T-bill futures, and quasi-arbitrage - Fixed Income and Interest Rate Derivative Analysis [Book]

Treasury Bond Massacre, Mortgage Rates Hit 5.35%, Highest since 2009, and it's Only April | Wolf Street

The Notetaker on Twitter: "@PensionCraft MMFs can only invest in short duration assets (maturities date cannot be greater than 1 year). Demand for short-dated debt like T-Bills is high, but supply is

Kamakura Weekly Forecast, December 23, 2021: U.S. Treasury Probabilities 10 Years Forward - Kamakura Corporation

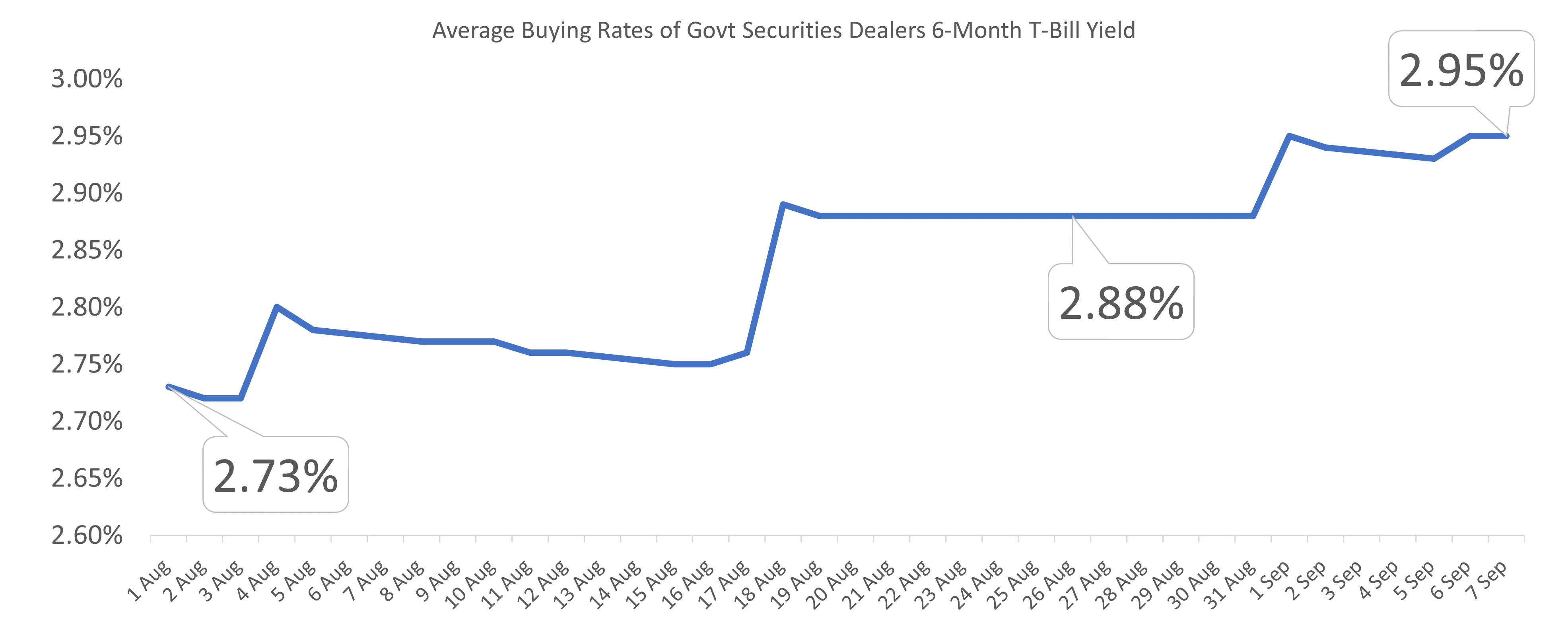

Current Singapore Fixed Deposits Are Worse Than the Mid-September's Singapore Treasury Bill Issue | Investment Moats

.1566992778491.png?w=929&h=523&vtcrop=y)